HOTELS quality Index 4T 2014 – Global

The 2014 have been the confirmation of the pathway of hotel competitiveness, according to the quality HOTELS Index, report made by HOTELS quality and Nebrija University.

The Hotels Quality Index analysis has completed five years. Observed a trend indicator for twenty quarters after -from 2010 until the end of 2014- of a progressive improvement, until stable in recent quarters. Being able to say, as in the case of Spain index for the field, which in turn, increases its significance and representativeness. Especially the effect of increasing the number of records considered. In the fourth quarter 2014, more than 20.000.

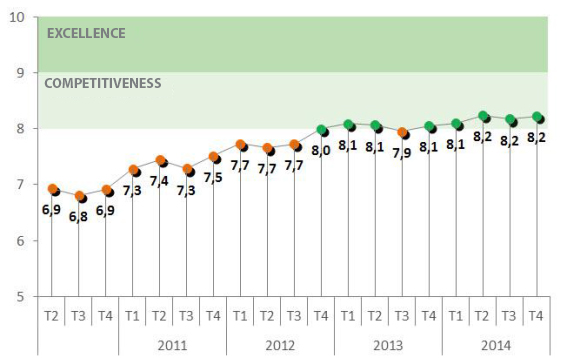

The generic impression of the evolution shows that in the case of Global we are at the threshold of the area of competitiveness. Established by convention, above 8 points, because during the last three quarters has remained at a rate equal to 8,2. And since the last quarter of 2012 (two years), it has gone from a impression and valuation of 8,0 points, to a recognizing the quality, penetrating slightly in the area of competitiveness of 8,2

It can be affirmed that the consolidation of the sample is the principal cause of stability results in the proximity of 8,2 points. We must not be understood the decline occurred in the third quarter of 2013, from 8,1 to 7,9 but as a progressive adaptation to the sample size, by effect of improving the representativeness of records processed.

Evolution of global media

General overview of results

In the fourth quarter of 2014 the HOTELS quality Index Global closes keeping the same values as the previous quarter. The index remains, constant at 8,2 points. Perceiving -with stability of the sample- a slightly increasing trend.

That is since the third quarter of the year has reached the permanence of a rate equal to 8,2. Which shows us some consistency in maintaining the quality level and representativeness of the results.

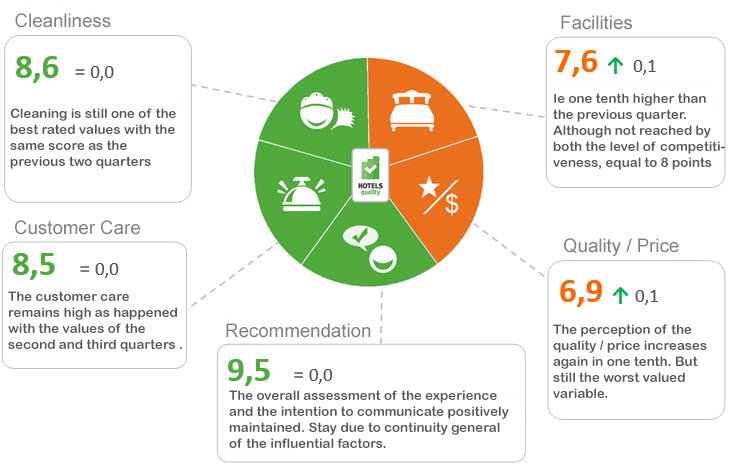

Partial view of the results

- Cleanliness

Cleanliness is the best valued aspect except for the factor of recommendation and it remains at the same values of the previous quarter, with a note of 8,6, as weighted average. Having increased significantly over the data of the initial time.

- Facilities

This aspect is projected with positive sign, increasing the value to 7,6 it mean a tenth higher than the previous quarter. Although not reach therefore to level of competitiveness, equal to 8 points. Showing which are the lower class hotels whom report the lowest satisfaction.

- Customer care

The Customers care continues remains one of the highest rated indicators. This time, compared to last quarter, responses not quantitatively present changes in the factor facilities, maintaining 8,5. Definitely a highly integrated value in the area of competitiveness.

- Quality / Price

The perception of quality / price relation increase again by one tenth. But still the worst valued variable. 6,9. Assessment that requires a more complex interpretation, considering, as described in the aforementioned display only the Spanish side, a set of considerations, which extends the strict concerning customer perception.

- Recommendation

The value that measures the global image that customers take the hotel remains at a valuation of 9,5. Permanence due to the continuity in general of the influential factors. Although part of the four-level motivators, two of them increase each one a tenth, and the remaining two are kept. Which marks a trend progresses on the global assessment, and inserted into the area of excellence.

Changes of improvement in the assessment elements

| 2015/2010 | 2015/2012 | |

| Cleanliness | 26,5 | 3,6 |

| Facilities | 31,0 | — |

| Customers care | 18,1 | 2,4 |

| Quality / Price relation | 32,7 | 3,0 |

| Recommendation | 5,6 | 1,1 |

The table reflected over the evolution of improved assessment elements, explains that for the initial period, where the sample was not less representative, are the facilities and Quality / Price relation, the most improved. But it is interesting to note, those are the two factors that need more progress, per cause of the value they currently offer.

With regard to improvement in the past two years, apparently in the short term the cleanness and quality/price relation were getting better. Observed that the high value reached by the recommendation element, it seems, is the element that has less traveled.